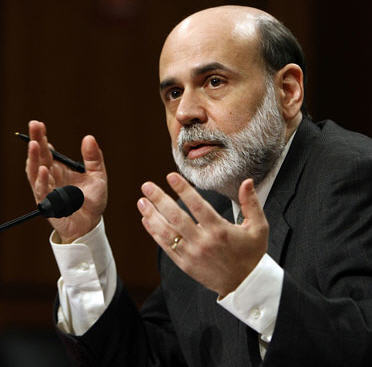

| " I'm goin' to Jackson. See if I care ." - Johnny Cash. Last week, Fed Chair Ben Bernanke headed to Jackson Hole, Wyoming…and the markets certainly cared! The big news of the week was Bernanke's speech at the Federal Reserve Bank of Kansas City Economic Symposium at Jackson Hole. Here's what happened - and, more importantly, what it means to Bonds and home loan rates.

Bernanke Remains Optimistic. Bernanke focused on the near-term Bernanke Remains Optimistic. Bernanke focused on the near-term and long-term economic situation, but his message was optimistic, stating that regardless of "the crisis and the recession, the U.S. economy remains the largest in the world." He stated that the Fed expects "a moderate recovery" to continue and even strengthen as the country goes forward.

Easy on the talk of "Easing." Despite the market's concerns over the slowing economic recovery, Bernanke didn't discuss any details about the measures that the Fed may use to help get the recovery back on track - which means there was no mention of a third round of Quantitative Easing (QE3). Instead, he stated that the Fed would continue to consider such options at its upcoming September meeting. He did, however, re-iterate that "The Fed has a range of tools that could be used to provide additional monetary stimulus." Additionally, he ended his speech by saying: "The Federal Reserve will certainly do all that it can to help restore high rates of growth and employment in a context of price stability."

Right back where we started. It's interesting to note that last year when Bernanke spoke at Jackson Hole he talked about the likelihood of QE2. That speech sent both the Bond and Stock markets into a rally mode. Amazingly, the Stock market is very close to levels seen last August, which means that Stocks have given up virtually all of the gains seen from the enormous rally sparked by QE2.

Anticipation and disappointment. Stocks traded higher early last week in anticipation of Fed Chairman Ben Bernanke's big speech on Friday at Jackson Hole, Wyoming. With the economy slumping and Stock prices falling in recent weeks, there was a growing feeling that the Fed is willing do something that would signal to the markets that they are willing to help more if needed.

After Bernanke's speech - and his reluctance to discuss QE3 - Stocks dropped slightly, signaling investor's disappointment in having to wait longer to see what steps the Fed may take. By late Friday, however, volatility reared its head again, as Stocks attempted to rally and Bonds gave up some of their gains.

With the Fed pushing off any meaningful discussion of its policies and options until the September meeting, this story is sure to continue impacting the markets. Until we hear exactly what the Fed will do, the markets will be forced to speculate and anticipate… which could mean more volatility. For now, the situation looks beneficial for people looking to purchase a home or refinance, as home loan rates remain near historic lows. But things can change quickly, so now is the time to take a look at the options available. |