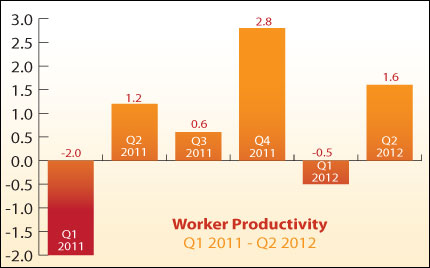

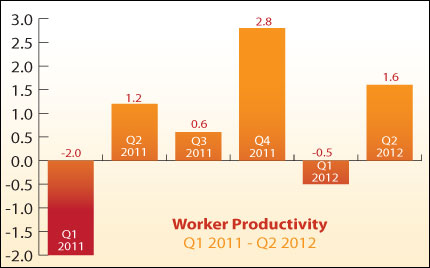

| "Where do we go from here?" - Alicia Keys. And after a volatile week in the markets, you may be wondering where Bonds and home loan rates go from here. Read on for details.  There were only There were only two economic reports released last week, and the news from them was mixed. Productivity rose 1.6% in the 2nd quarter of 2012. Higher productivity signals that companies are squeezing more out of their current employees and may not add workers, which could slow job growth. There was a bit of good news on the labor front, though, as Initial Jobless Claims came in below expectations, declining to 361,000.

Also of note, the Fed's Eric Rosengren stated that the current U.S. economic outlook calls for another round of Bond buying (known as Quantitative Easing, or QE3). Remember that once an official announcement about QE3 is made, Bonds and home loan rates could suffer as Stocks would likely rally.

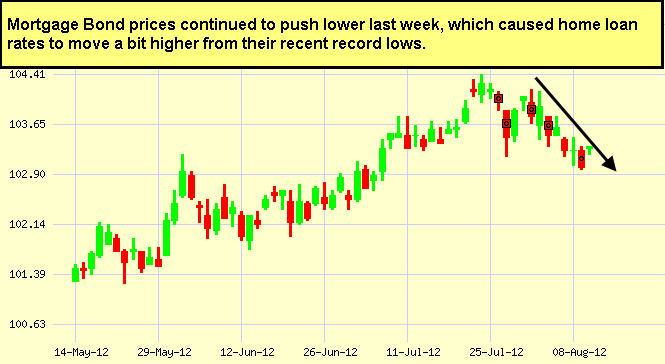

So where do Bonds and home loan rates go from here? While Bonds and home loan rates worsened last week due to some optimism out of Europe and a better than expected Jobs Report for July, there are many reasons why Bonds and home loan rates should have better weeks ahead. There is evidence of a weakening economy here in the U.S. For example, the expectations component of the University of Michigan Consumer Sentiment Report came in at 65.6 in July, the lowest reading of 2012.

In addition, the ongoing problems in Europe and the upcoming election this fall will bring uncertainty...and Bonds (and therefore home loan rates, which are tied to Mortgage Bonds) typically benefit from uncertainty, as investors see Bonds as a safe haven for their money. Technical trading levels will also be an important factor to watch closely in determining what happens next with Stocks, Bonds, and home loan rates.

The bottom line is that now is a great time to consider a home purchase or refinance, as home loan rates remain near historic lows. Let me know if I can answer any questions at all for you or your clients. |