|

|

|

Last Week in Review:

There was another sign that the housing market continues to recover. Plus,

chatter about the Fed.

Forecast for the Week: The markets are closed Monday for Presidents'

Day, but important housing and inflation news will be released later in the

week.

View: Thinking less may actually help you get more

done. Check out why below.

|

|

|

|

"Ease

on down the road." The song from the musical The

Wiz could also apply to recent chatter in the markets, regarding

whether the Fed will continue to "ease on" with their Bond buying

program, known as Quantitative Easing. Read on for details and what they

mean for home loan rates.

Quantitative

Easing is the concept of the Fed becoming a buyer of Treasuries and Bonds

to try and stimulate the economy. Oftentimes, the Fed does Quantitative

Easing when they are hoping to (1) create inflation and avoid a

deflationary economy, (2) lower the unemployment rate, and (3) boost Stock

prices. Quantitative

Easing is the concept of the Fed becoming a buyer of Treasuries and Bonds

to try and stimulate the economy. Oftentimes, the Fed does Quantitative

Easing when they are hoping to (1) create inflation and avoid a

deflationary economy, (2) lower the unemployment rate, and (3) boost Stock

prices.

Over the last few months, the Fed has bought large amounts of Mortgage

Bonds through their Quantitative Easing program to keep home loan rates

(which are tied to Mortgage Bonds) near record lows, and to help strengthen

our housing market and economy overall. And the housing market has

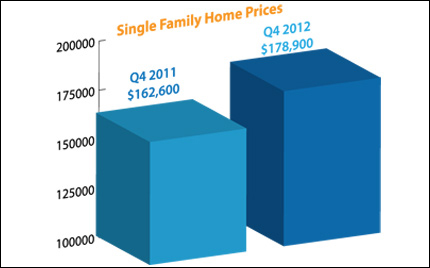

definitely seen some improvement. Last week, the National Association of

Realtors reported that the national median existing single-family home

price surged 10% since this time last year to $178,900. The year-over-year

increase of 10% was the largest gain since the fourth quarter of 2005.

This is one of the big reasons the Fed will likely continue their

Quantitative Easing program: The housing market is on the mend and stopping

the program could threaten the housing recovery.

So what is the bottom line? Stocks continue to do well--at

the expense of Bonds and home loan rates. However, the debt crisis

continues in Europe: Spain, Italy and Greece remain in contracting

economies and now France and Germany have shown negative GDP growth that

was even worse than expected. This means that investors will likely

continue to see our Bond market as a safe haven for their money, which

could ultimately benefit Bonds--and home loan rates, which are tied to

Mortgage Bonds--in the process.

The biggest take away is that home loan rates remain near historic

lows, making now a great time to consider a home purchase or refinance. Let

me know if I can answer any questions at all for you or your clients.

|

|

|

|

|

Chart: Fannie Mae 3.0% Mortgage Bond (Friday Feb 15, 2013)

The

markets are closed Monday in observance of the Presidents' Day holiday, but

look for several important reports later in the week. The

markets are closed Monday in observance of the Presidents' Day holiday, but

look for several important reports later in the week.

- Housing news hits the wires, with Housing Starts

and Building Permits on Wednesday and Existing Home Sales

on Thursday.

- We'll get a double dose of inflation news with

Wednesday's wholesale-measuring Producer Price Index, followed

by the Consumer Price Index on Thursday.

- Also on Thursday, Initial Jobless Claims and

the Philadelphia Fed Index will be reported.

In addition, the

minutes from the January meeting of the Federal Open Market Committee will

be released on Wednesday at 2:00pm ET. With all the differing opinions of

the Fed governors and the chatter about Quantitative Easing, this has the

potential to move the markets.

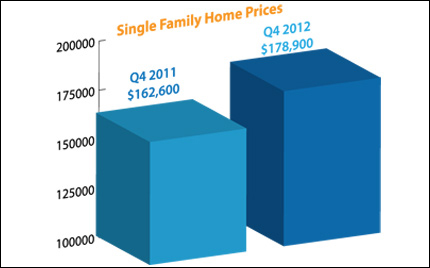

Remember: Weak economic news normally causes money to flow out of Stocks

and into Bonds, helping Bonds and home loan rates improve, while strong

economic news normally has the opposite result. The chart below shows

Mortgage Backed Securities (MBS), which are the type of Bond that home loan

rates are based on.

When you see these Bond prices moving higher, it means home loan

rates are improving -- and when they are moving lower, home loan rates are

getting worse.

To go one step further -- a red "candle" means that MBS worsened

during the day, while a green "candle" means MBS improved during

the day. Depending on how dramatic the changes were on any given day, this

can cause rate changes throughout the day, as well as on the rate sheets we

start with each morning.

As you can see in the chart below, Bonds and home loan rates have been

impacted by the rally in Stocks. However, home loan rates remain near

record lows and I'll continue to monitor them closely.

|

|

|

|

The Mortgage

Market Guide View...

|

|

|

|

|

|

Rituals of Success

How to Get More Done By Thinking Less

If you've ever felt like you can't find time to get to your list of

important things, you're not alone. New York Times best selling

author Tony Schwarz says almost 75 percent of workers around the world feel

disengaged at work and that the "more, bigger, faster" mantra is

to blame. We are busier than ever, trying to get more done with fewer

resources.

Schwarz suggests everything we do--whether checking email, exercising, or

resisting the temptation to eat an extra cookie--often requires thinking,

and thinking takes energy. So, if you want to get more done you must

actually think less.

In 1911, philosopher A.N. Whitehead wrote: "It is a profoundly

erroneous truism that we should cultivate the habit of thinking of what we

are doing. The precise opposite is the case. Civilization advances by

extending the number of operations we can perform without thinking

about them."

The answer, according to Schwarz, is to make important things automatic,

what he calls a ritual. Rituals are highly specific behaviors performed

at a specific time. He reports the five rituals that have made the most

difference in his life are:

- Sticking to a bedtime that ensures he gets at least

8 hours of rest.

- Working out first thing in the morning, whether he

feels like it or not.

- Starting his workday by doing the most important

task first--decided the night before--and working only in 90-minute

time blocks with a definite break in between.

- Writing down his good ideas immediately, so they

aren't bouncing around in his mind all day, or worse, forgotten

entirely.

- When upset by someone or something, he ritually

asks how he can see the same set of facts in a more hopeful or

empowering way.

Remember, the less you

have to think about your goals as you perform the steps to achieve them,

the more likely you are to check them off your list.

Economic

Calendar for the Week of February 18 - February 22

|

Date

|

ET

|

Economic Report

|

For

|

Estimate

|

Actual

|

Prior

|

Impact

|

|

Wed. February 20

|

08:30

|

Housing Starts

|

Jan

|

910K

|

|

954K

|

Moderate

|

|

Wed. February 20

|

02:00

|

FOMC Minutes

|

1/30

|

NA

|

|

NA

|

HIGH

|

|

Wed. February 20

|

08:30

|

Core Producer

Price Index (PPI)

|

Jan

|

0.1%

|

|

0.1%

|

Moderate

|

|

Wed. February 20

|

08:30

|

Producer Price

Index (PPI)

|

Jan

|

0.3%

|

|

-0.2%

|

Moderate

|

|

Wed. February 20

|

08:30

|

Building Permits

|

Jan

|

918K

|

|

903K

|

Moderate

|

|

Thu. February 21

|

08:30

|

Jobless Claims

(Initial)

|

2/16

|

358K

|

|

341K

|

Moderate

|

|

Thu. February 21

|

08:30

|

Core Consumer

Price Index (CPI)

|

Jan

|

0.2%

|

|

0.1%

|

HIGH

|

|

Thu. February 21

|

10:00

|

Existing Home

Sales

|

Jan

|

4.94M

|

|

4.94M

|

Moderate

|

|

Thu. February 21

|

10:00

|

Philadelphia Fed

Index

|

Feb

|

1.5

|

|

-5.8

|

HIGH

|

|

Thu. February 21

|

08:30

|

Consumer Price

Index (CPI)

|

Jan

|

0.1%

|

|

0.0%

|

HIGH

|

|

|

|

|

The material

contained in this newsletter is provided by a third party to real estate,

financial services and other professionals only for their use and the use

of their clients. The material provided is for informational and

educational purposes only and should not be construed as investment and/or

mortgage advice. Although the material is deemed to be accurate and

reliable, we do not make any representations as to its accuracy or

completeness and as a result, there is no guarantee it is without errors.

As your mortgage

professional, I am sending you the MMG WEEKLY because I am committed

to keeping you updated on the economic events that impact interest rates

and how they may affect you.

is the copyright

owner or licensee of the content and/or information in this email, unless

otherwise indicated. does not grant to you a license to any content,

features or materials in this email. You may not distribute,

download, or save a copy of any of the content or screens except as

otherwise provided in our Terms and Conditions of Membership, for any

purpose.

|

|