|

| |

|

|

| |

"WE'VE WANDERED MANY A WEARY FOOT, SINCE AULD LANG SYNE." - The Scottish tune Auld Lang Syne

is commonly sung at the stroke of midnight on New Year's. While the

literal translation of the title means "old long ago," the loose

translation can be thought of as "for the sake of old times."

This year, the tune seems particularly appropriate, as the U.S. economy

has traveled a weary road over the last few years. The economic concerns

may not be completely behind us (just look at the Fiscal Cliff standoff

for evidence of that), but the outlook looks better than it did a few

years ago. The articles below can help you ring in the New Year with

information and tips you need to know:

- Home for the New Year - The housing industry received mixed news last month, but the overall direction looks positive.

- What to Watch - What does the Fed's recent announcement of more Quantitative Easing mean for the economy? Find out below.

- Comfy and Cozy - Use these tips to create a warm décor after the holidays.

- Q&A: Labor Force Participation? - What is the Labor Force Participation Rate? The answer is more important than you may think!

Have a safe and happy new year. And if you have any

questions or would like to discuss your unique situation, call or email

today. Please forward this newsletter to friends, family members and

coworkers who may find this information helpful.

|

|

| |

Home for the New Year's Holiday |

As

we head into the new year, there is mixed news in the housing market.

For example, the most recent New Home Sales report came in last month

worse than expected, but Existing Home Sales jumped nearly 6% to come in

better than expected. Similarly, the most recent Housing Starts report

came in below expectations, but Building Permits rose 3.5% to come in

better than anticipated. As

we head into the new year, there is mixed news in the housing market.

For example, the most recent New Home Sales report came in last month

worse than expected, but Existing Home Sales jumped nearly 6% to come in

better than expected. Similarly, the most recent Housing Starts report

came in below expectations, but Building Permits rose 3.5% to come in

better than anticipated.

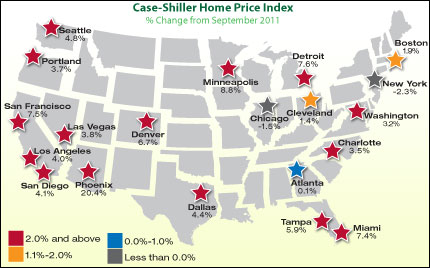

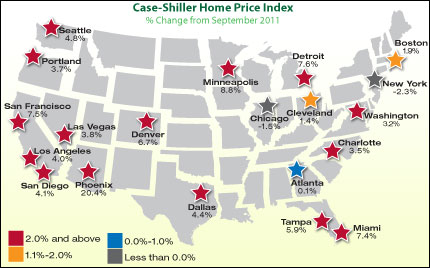

Even home prices received mixed news. Last month's release of the Case

Shiller Index reported that home prices were up 3% from September 2011.

The chart accompanying this article shows the latest increases across

the country. However, shortly after the release of the report on home

prices, Robert Shiller (of the Case Shiller Index) warned that we could

see home prices dip again in 2013.

The bottom line is that the housing market is still experiencing

challenges that won't go away overnight, but it is showing signs of

recovery and the overall trend in 2013 looks positive.

Speaking of housing, do you know how many people live in the United

States as we ring in the new year? According to the U.S. Census Bureau,

the projected population is 315 million people. That's a lot of people

looking forward to continued economic recovery--and maybe even a new

home--in 2013.

One thing is for sure: This year will surely have its challenges, but it

will also be filled with hope and opportunity. This time of year is

ideal for looking forward to those opportunities, as we also reflect on

where we've come from. After all, the month of January is named after

Janus, the Roman mythical god known for the ability to look back and

forward at the same time.

Happy New Year to you and your family! May you be blessed with

happiness and opportunities in 2013. And if I can be of any assistance,

please just call or email. |

|

| |

What to Watch: Quantitative Easing in 2013 |

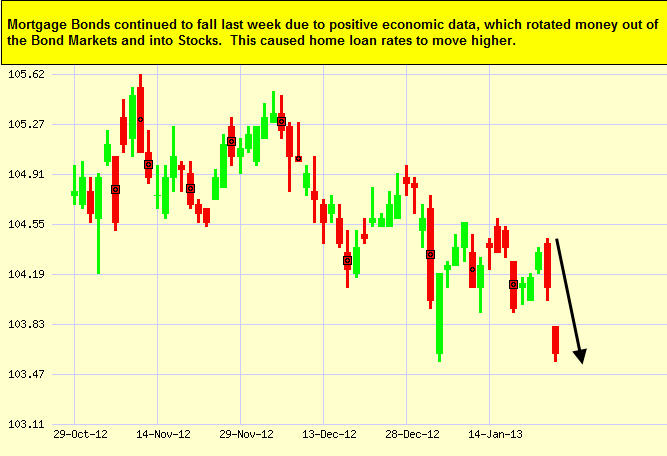

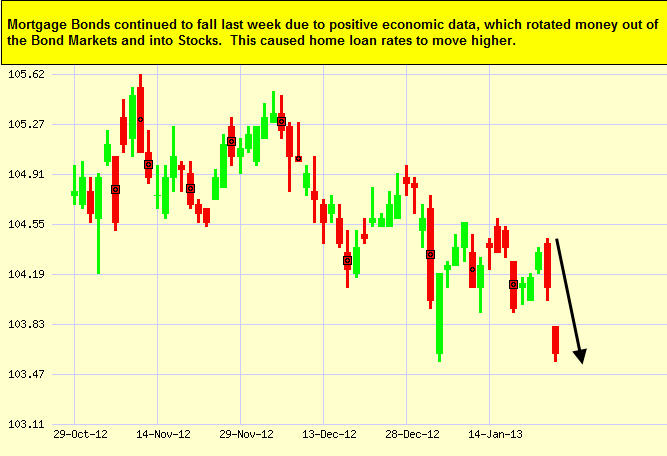

In

their final meeting of 2012, the Fed vowed to continue the third round

of their Bond buying strategy (known as Quantitative Easing or QE3).

They also announced they will begin a fourth round of Quantitative

Easing in January.

But what really took the markets by surprise was the Fed's decision to

tie the Fed Funds Rate (the rate banks charge each other for lending

money overnight) to the Unemployment Rate. Instead of sticking with

their plan of maintaining low rates until "at least mid-2015," now the

Fed is going to hold the Fed Funds Rate steady as "long as the

Unemployment Rate remains above 6.5%."

One of the biggest takeaways from this decision is that the Fed may be

more tolerant of a rise in inflation. Lower unemployment would mean that

the economy is gaining some steam, thanks in part to the stimulus

programs like QE3 that are currently underway, and inflation could

easily trend higher in an improving economy. Remember, inflation is the

archenemy of Bonds--and, therefore, of home loan rates, since home loan

rates are tied to Mortgage Bonds--because inflation reduces the value of

fixed investments like Bonds.

Recent reports have shown that inflation remains tame. However, when

inflation manifests, it tends to do so quickly. So the Fed's Quantiative

Easing (as well as inflation) will be important to watch in the weeks

and months ahead.

| |

Comfy and Cozy:

3 Decorating Tips for a Warm Decor After the Holidays |

The

holidays are over and you're slowly getting your house back to normal.

But that doesn't mean you have to pack away the cozy, comfortable

feeling all those holiday decorations add to your home.

With some simple decorations or re-arranged furniture, you can keep the

cozy feeling for the rest of the winter months. Here are 3 simple tips

that can help.

1. Coziness is in the details

Every family has traditions and memories that are unique, so celebrate

those differences with subtle reminders around your house. Just remember

not to go overboard. A little here, a little there can go a long way to

creating a warm, inviting atmosphere. But too much will look cluttered

and chaotic. Try decorating your home with some of the following:

Family photos--Groupings of family photos should be first on your

list. Find shelf space or side tables that could use a personal touch,

and then add a few family photos. The frames don't have to match, but

they should coordinate...and they should have the same design as the

mood you're trying to create. If it's coziness you seek, try adding rich

wood frames and classic designs to your decor.

Heirlooms and antiques--You'd be surprised what an antique camera

can add to a display of family photos. Or how an antique vase can set

the tone for an entire room. These items are inexpensive to purchase at

an antique store, but if you have a family heirloom with a story it's

even better.

Personal or seasonal touches--Remember, your family and your

community are unique and should be celebrated. So, for example, if your

family took a unique vacation to a sandy beach last year, you can fill a

decorative jar with the sand and surround it with a photo or two. Or,

you can simply bring natural elements-such as pinecones or autumn

leaves-inside and place them in a large bowl or dish with photos or

candles.

Warm the senses--Don't forget to fill the air with a fresh

fragrance that fits the mood you're creating. Often, those fresh scents

are the first things that visitors notice. So consider lighting scented

candles, purchasing plug-in air fresheners with seasonal scents, or just

baking homemade cookies before company arrives.

2. Setting the scene

This time of year, you're probably re-arranging some of your rooms after

packing away holiday decorations. Before you settle back into your old

layout though, take a few minutes to think about how your furniture can

add to the coziness of your house.

Start with the seating. For instance, can you place the sofa and a few

armchairs so they're facing each other-making it natural and comfortable

for people to sit and visit? If you have a fireplace, this is the

perfect time of year to make that the focal point of the room (you can

always arrange your seating around the television once the winter season

is over). Area rugs and throw pillows can help tie the furniture

together and create a cohesive, warm feeling.

Also look for cozy corners where you can place two chairs and a small

game table for checkers or cards. For even smaller spaces, consider

placing a single chair, a lamp, and a stack of books or magazines for an

inviting retreat.

3. A soft, warm glow

One of the easiest and most inexpensive ways to set the mood in a room

is to adjust your lighting. Remember, those bright overhead lights are

often harsh on the eyes and don't help create the warm atmosphere you're

seeking. Try adding a few floor lamps, small table lamps, and even wall

sconces for softer, more indirect lighting. Also, use lower wattage

bulbs in your lights for a more relaxed environment.

During the day, make sure you're taking full advantage of the natural

light that enters your house. For example, don't place larger,

dark-colored objects too close to your windows; even if they don't block

the light, they'll make the window feel smaller and will overpower the

natural light that's trying to enter.

Finally, don't forget that the best light source is sometimes a candle.

You can set a single candle on a table or create a grouping on a mantle,

in a fireplace, or on a wall sconce. You can even place them in front

of a mirror to heighten the impact. But don't feel like you have to

overdo it...even small votive candles can make a big difference.

NOTE: If you have young children or are concerned about a fire hazard in

a certain location, you can opt for the warm glow of a fake candle.

There are a number of sizes and options available today. Most are

inexpensive and look quite real.

Follow these 3 simple steps or get creative and come up with ideas

of your own to help warm up the winter months with a cozy, comfortable

home decor.

| |

Q&A: Labor Force Participation? |

QUESTION: What is the Labor Force Participation Rate...and why does it matter?

ANSWER: The article above stated that the Fed

recently tied their Quantitative Easing strategy to unemployment. But,

when we talk about unemployment, we need to consider how many people are

out of work and how many people aren't even looking for work. That

means, we need to look at two reports: (1) the official Unemployment

Rate and (2) the Labor Force Participation Rate.

Last month, the Labor Department reported that the Unemployment Rate hit

7.7%, the lowest level since December 2008. On the surface, that seems

like a positive sign for the labor market and the U.S. economy. But it

is also important to understand that the decrease in the Unemployment

Rate was due in part to 350,000 people dropping out of the workforce.

That's where the Labor Force Participation Rate (LFPR) comes in. The

LFPR calculation is quite simple. If you are 16 years old and not in the

military, then you either have a job or you don't. The ratio of people

"participating" or working is then compared to the total population.

Last month's report indicated that the LFPR fell to the lowest reading

in over 31 years. So some of the good news regarding the lower

Unemployment Rate is offset by the fact that fewer people are even

participating or looking for work. Those two reports will be important

to watch as we head into 2013, especially since the Fed is tying

Quantitative Easing to the Unemployment Rate.

|

| |

|

|

| |

The material contained in this newsletter has been

prepared by an independent third-party provider. The material provided

is for informational and educational purposes only and should not be

construed as investment, financial, real estate and/or mortgage advice.

Although the material is deemed to be accurate and reliable, there is no

guarantee it is without errors.

As your Trusted Advisor, I always want to make sure

you are clear on all details of the home financing process. If you or

someone you know are interested in purchasing or refinancing a home,

give me a call today!

Mortgage Success Source, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Success Source, LLC

does not grant to the recipient or distributor a license to any

content, features or materials in this email. You may not distribute,

download, or save a copy of any of the content except as otherwise

provided in our Terms and Conditions of Membership, for any purpose. |

As

we head into the new year, there is mixed news in the housing market.

For example, the most recent New Home Sales report came in last month

worse than expected, but Existing Home Sales jumped nearly 6% to come in

better than expected. Similarly, the most recent Housing Starts report

came in below expectations, but Building Permits rose 3.5% to come in

better than anticipated.

As

we head into the new year, there is mixed news in the housing market.

For example, the most recent New Home Sales report came in last month

worse than expected, but Existing Home Sales jumped nearly 6% to come in

better than expected. Similarly, the most recent Housing Starts report

came in below expectations, but Building Permits rose 3.5% to come in

better than anticipated. In

their final meeting of 2012, the Fed vowed to continue the third round

of their Bond buying strategy (known as Quantitative Easing or QE3).

They also announced they will begin a fourth round of Quantitative

Easing in January.

In

their final meeting of 2012, the Fed vowed to continue the third round

of their Bond buying strategy (known as Quantitative Easing or QE3).

They also announced they will begin a fourth round of Quantitative

Easing in January.  The

holidays are over and you're slowly getting your house back to normal.

But that doesn't mean you have to pack away the cozy, comfortable

feeling all those holiday decorations add to your home.

The

holidays are over and you're slowly getting your house back to normal.

But that doesn't mean you have to pack away the cozy, comfortable

feeling all those holiday decorations add to your home.