KISS the Chef

How Doing Too Much Can Kill Your Business

Kitchen Nightmares, featuring Scottish chef Gordon Ramsay, was a

long running hit show in Britain well before FOX brought it to Americans

in 2007. The show presents a critical lesson for business owners and

professionals everywhere: don't let things get too complicated.

From the elaborate menus to strange customer service habits, the

"broken" restaurants featured on the show persist, day after day, to

slowly choke out the ability to do what they are supposed to--fulfill

the need of customers efficiently and consistently. It's a lesson well

worth listening to, especially from Gordon Ramsay. He is recipient of 15

Michelin Stars and no stranger to success, but he's also admitted

losing a few of his own restaurants to mismanagement and over-extension.

Kitchen Nightmares makes the viewer keenly feel the validity of the

"KISS principle". KISS is an acronym for "Keep it simple stupid" and it

was coined by U.S. Navy engineers in 1960 to stress the importance of

building aircraft that could be repaired on the battlefield by a regular

mechanic using only basic tools. Essentially, the KISS principle states

that most systems work better when they are simple rather than complex.

Here are a few ideas on how to keep things simple in your business:

Identify the need you fulfill. Whether you sell homes or

financial services you are fulfilling a need for your clients that has

nothing to do with real estate or stocks and bonds--try to think of the

psychological need you fulfill.

Build your plan to serve that need. You may

have the ability

to offer other services that don't serve the core need of your market,

but avoid the temptation to use them if possible. The likelihood of

confusing your prospects and customers is too high to justify the value

you think you're creating.

Don't get too elaborate with systems. Especially the ones that

impact customer service. While every business should have processes for

everything, the more common sense they are the better. If yours are

intuitive and easy to perform for both staff and clients, they are going

to be win-win.

Stay focused. If you're in business to sell houses or do

financial planning, don't extend your brand to include staging or

insurance--or anything else you can think of that might dilute your

ability to perform the core need.

Feel free to pass this along to clients and colleagues who might benefit from these tips!

Economic Calendar for the Week of April 08 - April 12

Date

|

ET

|

Economic Report

|

For

|

Estimate

|

Actual

|

Prior

|

Impact

|

| Wed. April 10 |

02:00

|

FOMC Minutes |

3/20

|

|

|

|

HIGH

|

| Thu. April 11 |

08:30

|

Jobless Claims (Initial) |

4/6

|

NA

|

|

NA

|

Moderate

|

| Fri. April 12 |

08:30

|

Retail Sales |

Mar

|

NA

|

|

1.1%

|

Moderate

|

| Fri. April 12 |

08:30

|

Retail Sales ex-auto |

Mar

|

NA

|

|

1.0%

|

Moderate

|

| Fri. April 12 |

08:30

|

Producer Price Index (PPI) |

Mar

|

NA

|

|

0.7%

|

Moderate

|

| Fri. April 12 |

08:30

|

Core Producer Price Index (PPI) |

Mar

|

NA

|

|

0.2%

|

Moderate

|

| Fri. April 12 |

10:00

|

Consumer Sentiment Index (UoM) |

Apr

|

NA

|

|

78.6

|

Moderate

|

|

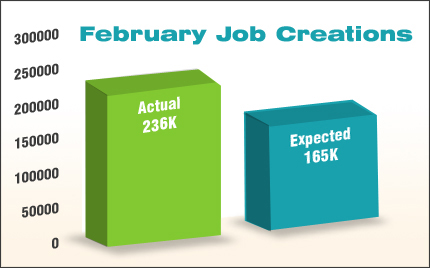

On

Friday, the Labor Department reported that 88,000 jobs were created in

March--less than half the 192,000 expected. This was the lowest monthly

job creations number since June 2012, and could be the beginning of a

slowdown in the labor market this spring. There was one small positive

note, however, as the number of job creations for January and February

were revised higher by 61,000.

On

Friday, the Labor Department reported that 88,000 jobs were created in

March--less than half the 192,000 expected. This was the lowest monthly

job creations number since June 2012, and could be the beginning of a

slowdown in the labor market this spring. There was one small positive

note, however, as the number of job creations for January and February

were revised higher by 61,000.

Housing Starts rose slightly in February, coming in above expectations

and up 28 percent since this time last year. Both Single-Family Housing

Starts and Building Permits (a sign of future construction) also

increased, reaching their highest levels since June 2008. In addition,

Existing Home Sales rose by 0.8 percent in February from January to an

annual rate of 4.98 million units. They are up 10.2 percent from the

February 2012 rate of 4.52 million units.

Housing Starts rose slightly in February, coming in above expectations

and up 28 percent since this time last year. Both Single-Family Housing

Starts and Building Permits (a sign of future construction) also

increased, reaching their highest levels since June 2008. In addition,

Existing Home Sales rose by 0.8 percent in February from January to an

annual rate of 4.98 million units. They are up 10.2 percent from the

February 2012 rate of 4.52 million units.