|

|

Last

Week in Review: Important inflation news was released. Plus the Fed met.

Forecast for the Week: The economic calendar heats up, with news on

housing, inflation, manufacturing, and more.

View: There's a simple way to increase your credibility with clients

and referral partners. Check out the details below.

|

|

|

|

Actions

speak louder than words. Though last week, the Fed's

words and actions were both important, as the Federal Open Market Committee

(FOMC) met for its final regularly-scheduled meeting of 2012. Read on to

learn what the Fed said, and what happened to home loan rates.

As

expected, the Fed announced a fourth round of Bond Buying (known as

Quantitative Easing or QE4) in an effort to continue to spur on economic

growth and keep home loan rates low. But what really took the markets by

surprise was the Fed's decision to tie the Fed Funds Rate (the rate banks

charge each other for lending money overnight) to the Unemployment Rate.

Instead of sticking with their plan of maintaining low rates until "at

least mid-2015," now the Fed is going to hold the Fed Funds Rate

steady as "long as the Unemployment Rate remains above 6.5%." As

expected, the Fed announced a fourth round of Bond Buying (known as

Quantitative Easing or QE4) in an effort to continue to spur on economic

growth and keep home loan rates low. But what really took the markets by

surprise was the Fed's decision to tie the Fed Funds Rate (the rate banks

charge each other for lending money overnight) to the Unemployment Rate.

Instead of sticking with their plan of maintaining low rates until "at

least mid-2015," now the Fed is going to hold the Fed Funds Rate

steady as "long as the Unemployment Rate remains above 6.5%."

One of the biggest takeaways from this decision is that the Fed may be more

tolerant of a rise in inflation. Lower unemployment would mean that the

economy is gaining some steam, thanks in part to the stimulus programs like

QE3 that are currently underway, and inflation could easily trend higher in

an improving economy. And remember, inflation is the arch enemy of

Bonds–and therefore, of home loan rates, as home loan rates are tied to

Mortgage Bonds–because inflation reduces the value of fixed investments

like Bonds.

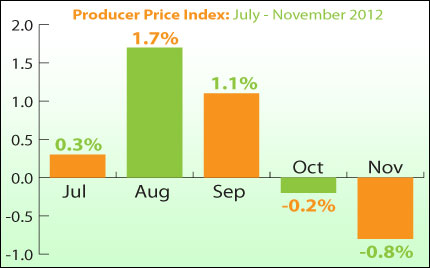

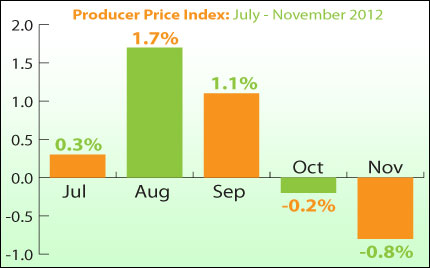

As of now, however, inflation at the wholesale and consumer levels remains

tame. The wholesale-measuring Producer Price Index (PPI) fell by 0.8% in

November, while the Consumer Price Index (CPI) fell by 0.3%, which was

below expectations. However, when inflation manifests, it tends to do so

quickly. This is a key area to keep a close eye on in the weeks and months

ahead.

So what does this mean for home loan rates? If inflation does

start to heat up, Bonds and home loan rates could be negatively impacted.

However, the continued uncertainty in the markets, both here with the

ongoing Fiscal Cliff saga and overseas with the debt crisis in Europe,

means that investors will likely continue to see our Bond market as a safe

haven for their money. This could benefit Bonds and home loan rates in the

process.

The bottom line is that now is a great time to consider a home

purchase or refinance, as home loan rates remain near historic lows. Let me

know if I can answer any questions at all for you or your clients.

|

|

|

|

Chart: Fannie Mae 3.0% Mortgage Bond (Friday Dec 14, 2012)

A

full week of economic reports is ahead, with news on manufacturing,

housing, inflation, and more. A

full week of economic reports is ahead, with news on manufacturing,

housing, inflation, and more.

- In manufacturing news, the Empire State Index

will be released on Monday with the Philadelphia Fed Index

being delivered on Thursday.

- Housing data will fill the airwaves this week with Housing

Starts and Building Permits on Wednesday and Existing

Homes Sales on Thursday.

- Weekly Initial Jobless Claims will be released as usual on Thursday. The numbers

have been ticking down as the impact of Hurricane Sandy has subsided.

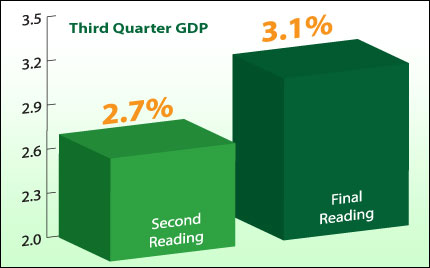

- Also on Thursday, look for the Gross Domestic

Product Report. It will be interesting to see if the third reading

for the third Quarter of 2012 will remain at 2.7% or if the figure

will be revised lower.

- Friday's data includes the inflation-measuring Core

Personal Consumption Expenditures. Inflation has been tame and the

Fed believes this will be the case for the foreseeable future.

- Rounding out the data on Friday, Personal Income

and Spending will be released along with Consumer Sentiment.

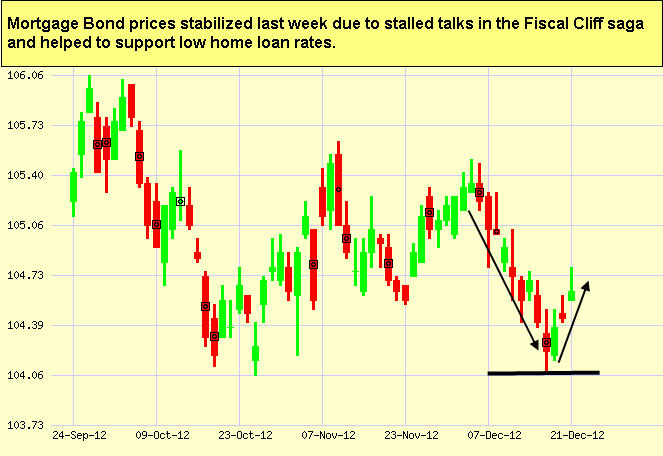

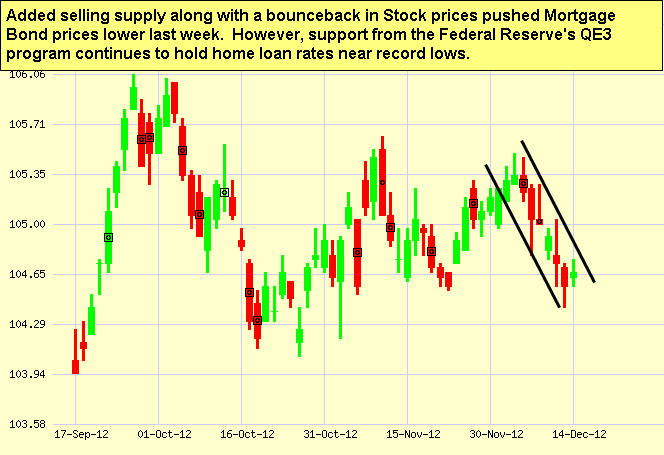

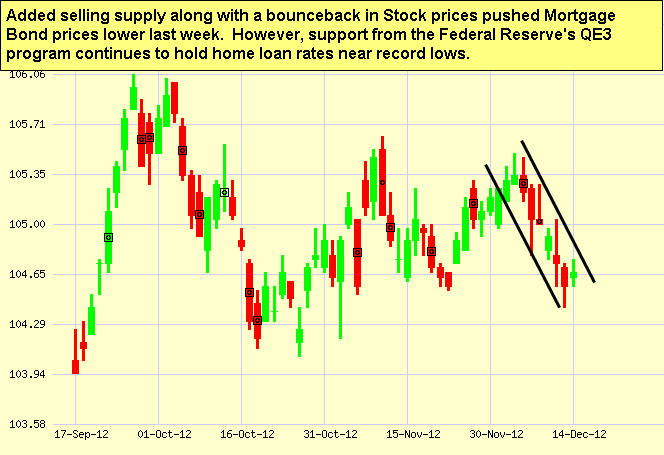

Remember: Weak

economic news normally causes money to flow out of Stocks and into Bonds,

helping Bonds and home loan rates improve, while strong economic news

normally has the opposite result. The chart below shows Mortgage Backed

Securities (MBS), which are the type of Bond that home loan rates are based

on.

When you see these Bond prices moving higher, it means home loan

rates are improving – and when they are moving lower, home loan rates are

getting worse.

To go one step further – a red "candle" means that MBS worsened

during the day, while a green "candle" means MBS improved during the

day. Depending on how dramatic the changes were on any given day, this can

cause rate changes throughout the day, as well as on the rate sheets we

start with each morning.

As you can see in the chart below, despite the tame inflation news, Bonds

and home loan rates worsened slightly due to added selling supply in the

markets and an improvement in Stock prices. However, Bonds and home loan

rates remain near record best levels and I will continue to monitor them

closely.

|

|

|

|

The Mortgage

Market Guide View...

|

|

|

|

The

Incredible Credibility Script

We all know that people follow the lead of credible and

knowledgeable experts. It's why professionals put diplomas on their wall,

car commercials mention their awards, and testimonials appear in

advertising. If you go around tooting your own horn to new prospects,

however, you can wear out your welcome fast.

Dr. Robert Cialdini, Professor Emeritus of Psychology and Marketing at

Arizona State University and author of the bestselling business book Influence:

The Psychology of Persuasion, discovered if someone else "toots

your horn," even if they don't have any expertise themselves–and even

if they have a financial interest in making the recommendation–prospects

are favorably influenced regardless.

Here's a simple strategy you can employ. Whenever a call comes in

requesting a particular service, have your receptionist briefly mention

your qualification or expertise before transferring the call. Even

something as simple as, "Let me transfer you to Bob, he has 20 years

of experience in that area," can make a difference to potential

clients. According to Cialdini's research, one company used that very

script and they saw a surprising 20% rise in the number of appointments and

a 15% rise in signed contracts. Not a bad return on investment!

While it's important to explain why you're a credible authority, it

doesn't always have to come from you. Try this technique out for yourself,

and then share it with other professionals in your referral network.

Economic

Calendar for the Week of December 17 - December 21

Date

|

ET

|

Economic Report

|

For

|

Estimate

|

Actual

|

Prior

|

Impact

|

Mon. December 17

|

08:30

|

Empire State

Index

|

Dec

|

NA

|

|

-5.2

|

HIGH

|

Wed. December 19

|

08:30

|

Housing Starts

|

Nov

|

NA

|

|

894K

|

Moderate

|

Wed. December 19

|

08:30

|

Building Permits

|

Nov

|

NA

|

|

866K

|

Moderate

|

Thu. December 20

|

10:00

|

Philadelphia Fed

Index

|

Dec

|

NA

|

|

-10.7

|

HIGH

|

Thu. December 20

|

10:00

|

Existing Home

Sales

|

Nov

|

NA

|

|

4.79M

|

Moderate

|

Thu. December 20

|

08:30

|

GDP Chain

Deflator

|

Q3

|

NA

|

|

2.7%

|

Moderate

|

Thu. December 20

|

08:30

|

Gross Domestic

Product (GDP)

|

Q3

|

NA

|

|

2.7%

|

Moderate

|

Thu. December 20

|

08:30

|

Jobless Claims

(Initial)

|

12/15

|

NA

|

|

NA

|

Moderate

|

Fri. December 21

|

08:30

|

Personal Income

|

Nov

|

NA

|

|

0.0%

|

Moderate

|

Fri. December 21

|

08:30

|

Personal

Spending

|

Nov

|

NA

|

|

-0.2%

|

Moderate

|

Fri. December 21

|

08:30

|

Personal

Consumption Expenditures and Core PCE

|

Nov

|

NA

|

|

0.1%

|

HIGH

|

Fri. December 21

|

08:30

|

Personal

Consumption Expenditures and Core PCE

|

Nov

|

NA

|

|

1.6%

|

HIGH

|

Fri. December 21

|

08:30

|

Consumer

Sentiment Index (UoM)

|

Dec

|

NA

|

|

74.5

|

Moderate

|

|

|

|

The material

contained in this newsletter is provided by a third party to real estate,

financial services and other professionals only for their use and the use

of their clients. The material provided is for informational and

educational purposes only and should not be construed as investment and/or

mortgage advice. Although the material is deemed to be accurate and

reliable, we do not make any representations as to its accuracy or

completeness and as a result, there is no guarantee it is without errors.

is the copyright

owner or licensee of the content and/or information in this email, unless

otherwise indicated. does not grant to you a license to any content, features

or materials in this email. You may not distribute, download,

or save a copy of any of the content or screens except as otherwise

provided in our Terms and Conditions of Membership, for any purpose.

|

|