|

|

|

Last Week in Review: The

Jobs Report for November was released. What did the data show, and how did

home loan rates react?

Forecast for the Week: Look for important news on inflation and

retail sales. Plus the Fed meets.

View: Many people have a fear of public speaking. Be sure to share

these simple tips with your clients, colleagues, and referral partners.

|

|

|

|

"Life

is a mixed blessing, which we vainly try to unmix." Author and journalist Mignon

McLaughlin. And the Jobs Report for

November turned out to have some mixed data, though un-mixing the numbers

is important for us to do. Read on for the details and the latest news on

home loan rates.

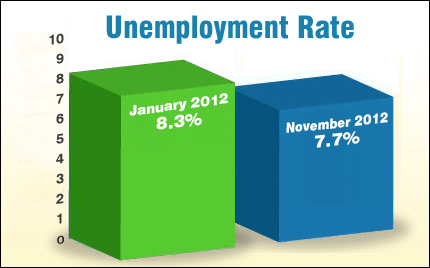

On

Friday the Labor Department reported that employers added 146,000 new jobs

in November, well above the 90,000 that was expected. In addition, the

Unemployment Rate hit 7.7%, the lowest level since December of 2008. On the

surface, both of these figures seem like a positive sign for the labor

market. On

Friday the Labor Department reported that employers added 146,000 new jobs

in November, well above the 90,000 that was expected. In addition, the

Unemployment Rate hit 7.7%, the lowest level since December of 2008. On the

surface, both of these figures seem like a positive sign for the labor

market.

But it is also important to understand that the decrease in the

Unemployment Rate was due in part to 350,000 people dropping out of the

workforce. And that's why the Labor Force Participation Rate (LFPR) fell to

63.6%, the lowest reading in over 31 years. The LFPR calculation is quite

simple. If you are 16 years old and not in the military, then you either

have a job or you don't. The ratio of people "participating" or

working is then compared to the total population. In addition, the biggest

increase in jobs was seen in the retail sector, which was probably due to

seasonal holiday hiring.

So what does this mean for home loan rates? Bonds and home

loan rates worsened slightly last week, in part due to the positive

headline numbers from the Jobs Report. But there is still much uncertainty

in the markets, both here due to the ongoing Fiscal Cliff saga and the

continued uncertainty in Europe. This means that investors will likely

continue to see our Bond market as a safe haven for their money. And since

home loan rates are tied to Mortgage Bonds, this continued uncertainty

could benefit home loan rates as well.

The bottom line is that home loan rates remain near historic lows,

making now a great time to consider a home purchase or refinance. Let me

know if I can answer any questions at all for you or your clients.

|

|

|

|

|

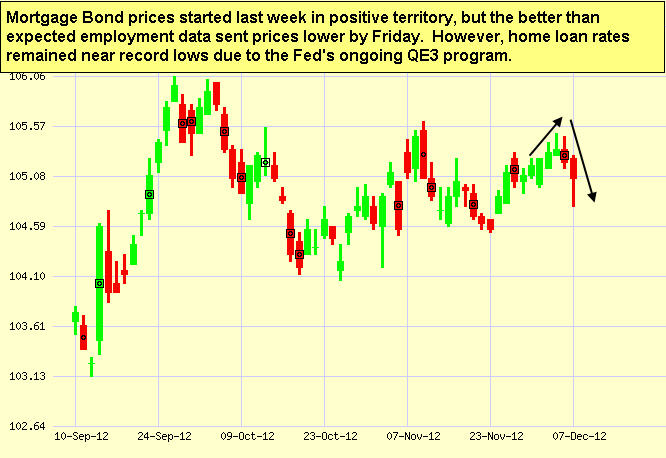

Chart: Fannie Mae 3.0% Mortgage Bond (Friday Dec 07, 2012)

The

second half of the week heats up with several important reports. The

second half of the week heats up with several important reports.

- Economic data doesn't begin until Thursday with Weekly

Initial Jobless Claims. Claims have been moving lower the past few

weeks after the big spike higher in November due to Superstorm Sandy.

- Retail Sales

will also be delivered on Thursday.

- A double dose of inflation news ends the week, with

the wholesale-measuring Producer Price Index on Thursday, followed

by the Consumer Price Index on Friday.

In addition, the last

Federal Open Market Committee meeting for 2012 will be held on Tuesday and

Wednesday, and that always has the potential to move the markets.

Remember: Weak economic news normally causes money to flow out of Stocks

and into Bonds, helping Bonds and home loan rates improve, while strong

economic news normally has the opposite result. The chart below shows

Mortgage Backed Securities (MBS), which are the type of Bond that home loan

rates are based on.

When you see these Bond prices moving higher, it means home loan

rates are improving – and when they are moving lower, home loan rates are

getting worse.

To go one step further – a red "candle" means that MBS

worsened during the day, while a green "candle" means MBS

improved during the day. Depending on how dramatic the changes were on any

given day, this can cause rate changes throughout the day, as well as on

the rate sheets we start with each morning.

As you can see in the chart below, Bonds and home loan rates reacted

negatively to the better than expected Jobs Report for November. But home

loan rates remain near historic lows and I will continue to monitor their

movement closely.

|

|

|

|

The Mortgage

Market Guide View...

|

|

|

|

|

|

Easy

Presentation Tips

For many people, public speaking is one of their greatest

fears. And the task of speaking to groups large and small can seem

daunting! What if you deluge people with too much information, give them

too many options, talk too much, bore them, or speak in jargon they don't

understand?

The good news is that there are some simple tips that can help make any

presentation shine:

Give the big picture. People love stories, so use ones that

illustrate how your ideas fit together. This will help people visualize and,

more importantly, relate to what you're telling them. Stories will also

help people relate to and connect with you, helping you build

rapport in the process.

Short is sweet. Don't spend too much time getting to the point. As

Winston Churchill once said, "The head cannot take in more than the

seat can endure."

Tell them what you want them to do. Most salespeople know how to ask

for the sale, but often forget to ask for everything else. If you want

agreement, ask for it. If you need information, ask for it. And most

important of all, say "thank you" when you get it!

Be conversational. The fastest way to lose people is

corporate-speak, jargon, or using big words when small ones will do.

Whenever you are presenting, just imagine yourself sitting next to someone

you are comfortable with for a friendly chat.

Economic

Calendar for the Week of December 10 - December 14

|

Date

|

ET

|

Economic Report

|

For

|

Estimate

|

Actual

|

Prior

|

Impact

|

|

Wed. December 12

|

12:30

|

FOMC Meeting

|

Dec

|

NA

|

|

0.25%

|

HIGH

|

|

Thu. December 13

|

08:30

|

Jobless Claims

(Initial)

|

12/8

|

375K

|

|

370K

|

Moderate

|

|

Thu. December 13

|

08:30

|

Retail Sales

|

Nov

|

0.4%

|

|

-0.3%

|

HIGH

|

|

Thu. December 13

|

08:30

|

Retail Sales

ex-auto

|

Nov

|

0.0%

|

|

0.0%

|

HIGH

|

|

Thu. December 13

|

08:30

|

Producer Price

Index (PPI)

|

Nov

|

-0.5%

|

|

-0.2%

|

Moderate

|

|

Thu. December 13

|

08:30

|

Core Producer

Price Index (PPI)

|

Nov

|

0.1%

|

|

-0.2%

|

Moderate

|

|

Fri. December 14

|

08:30

|

Consumer Price

Index (CPI)

|

Nov

|

-0.2%

|

|

0.1%

|

HIGH

|

|

Fri. December 14

|

08:30

|

Core Consumer

Price Index (CPI)

|

Nov

|

0.1%

|

|

0.2%

|

HIGH

|

|

|

|

|

The material

contained in this newsletter is provided by a third party to real estate,

financial services and other professionals only for their use and the use

of their clients. The material provided is for informational and

educational purposes only and should not be construed as investment and/or

mortgage advice. Although the material is deemed to be accurate and

reliable, we do not make any representations as to its accuracy or

completeness and as a result, there is no guarantee it is without errors.

As your mortgage

professional, I am sending you the MMG WEEKLY because I am committed

to keeping you updated on the economic events that impact interest rates

and how they may affect you.

is the copyright

owner or licensee of the content and/or information in this email, unless

otherwise indicated. does not grant to you a license to any content,

features or materials in this email. You may not distribute,

download, or save a copy of any of the content or screens except as

otherwise provided in our Terms and Conditions of Membership, for any

purpose.

|

|

No comments:

Post a Comment