| Survey says? Last week’s economic report calendar may have been light, but some important surveys revealed key data to note. Read on for the details...and how home loan rates fared.

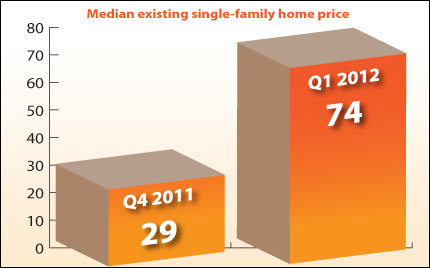

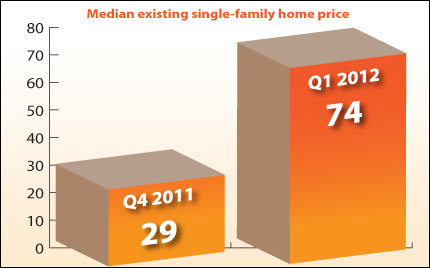

As you can see in the chart, As you can see in the chart, the National Association of Realtors (NAR) said that of the 146 Metro cities surveyed, home prices rose in 74 of them in Q1 2012. This is up from 29 cities that saw an increase in home prices in Q4 2011. In addition, the NAR also said that inventories for existing homes fell 22% since this time last year and are down 41% since the peak in mid-2007. While the housing market has a long way to go, this report was a nice step in the right direction.

There was also news from the National Federation of Independent Business, which said that its small business optimism index gained 2% in April as the survey revealed that companies have increased plans for hiring and investing in the future. While companies added new employees at a slower pace in April than in March, the index rose to 94.5 — the highest level since February of 2011. Overall, though, the report showed that our economy is improving but is still fragile. The state of our economy is part of the reason for the improvement in Bonds (and home loan rates, which are tied to Mortgage Bonds) of late.

Another big reason that Bonds and home loan rates have been improving is the fresh round of uncertainty out of Europe. France elected a new president, and this change of the guard represents the ninth EuroZone leader swap since the financial crisis began. Greece is also back in the news and their citizens are not taking to the austerity measures either. The New Democracy government, a pro-bailout party, is having trouble gathering the support to rule the government. This has sparked some safe haven trading into our Bonds, as investors see our Bonds as a safe place for their money.

The bottom line is that now continues to be a great time to purchase or refinance a home, as home loan rates remain near historic lows. Let me know if I can answer any questions at all for you or your clients. |