|

|  Inflation was a big story last month, with reports on both the wholesale and consumer levels. The wholesale-measuring Producer Price Index (PPI) showed that prices remained mostly unchanged during March. Remember, inflation hurts the value of fixed investments like Bonds (including Mortgage Bonds, to which home loan rates are tied)...so the lack of inflation on the wholesale side was good news for Bonds and home loan rates. Inflation was a big story last month, with reports on both the wholesale and consumer levels. The wholesale-measuring Producer Price Index (PPI) showed that prices remained mostly unchanged during March. Remember, inflation hurts the value of fixed investments like Bonds (including Mortgage Bonds, to which home loan rates are tied)...so the lack of inflation on the wholesale side was good news for Bonds and home loan rates.

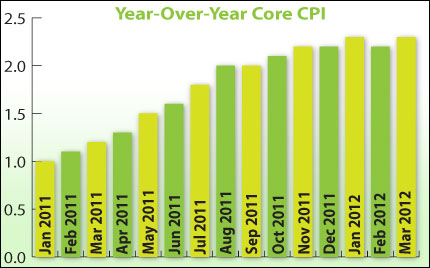

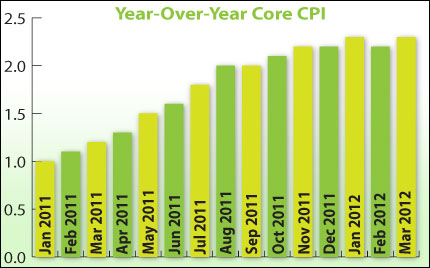

Last month, we also saw a new reading of the Consumer Price Index (CPI), which was inline with estimates. However, as you can see in the chart, the year-over-year number was slightly higher than the previous reading.

While the reading raised eyebrows a bit, the Fed is still reiterating that inflation remains subdued. For example, Fed Chair Bernanke recently noted that inflation is higher in the short-run due to higher energy costs, but he said that the Fed expects prices to moderate and remain in check longer-term. Despite those comments, inflation continues to be an important topic to watch. If the Core CPI continues to rise, Bonds and home loan rates will have a tough time improving much further, regardless of other factors.

The economy received some good news last month in terms of consumers. Retail Sales rose by a nice amount, as consumers bought all kinds of products across the board. This adds to the increasing trend seen in January and February, and it's a good sign for our economy, since consumers don't spend when they aren't feeling optimistic about their financial situation.

These news stories will continue to impact the direction in which Bonds and home loan rates move in the weeks ahead. The takeaway is that home loan rates remain near historic lows and now continues to be a great time to purchase or refinance a home. Let me know if I can answer any questions at all for you.

|

|

No comments:

Post a Comment