|

|

|

Last Week in Review: Surprising

jobs news for February, plus more good news on the housing front.

Forecast for the Week: Several key reports will be released in the

second half of the week, including inflation and retail sales. Plus, will

Stocks reach another record?

View: Want more attention from your marketplace? Be sure to read the

tips below.

|

|

|

|

It's

been said that "life is full of surprises." And

indeed, last week's Jobs Report contained several surprises. Read on to

find out if they were good or bad...and what they meant for home loan

rates.

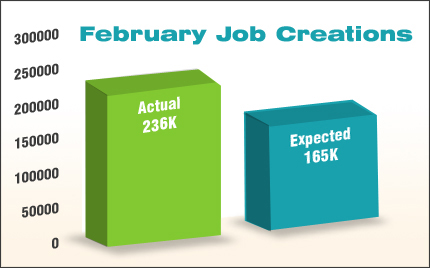

The

Jobs Report for February showed that 236,000 jobs were created, well above

the 165,000 that was expected. In addition, private employers added 246,000

new jobs in February, also well above expectations. While this is good

news, it's important to note that job creations in January were revised

downward to 119,000 from the previous reading of 157,000. The

Jobs Report for February showed that 236,000 jobs were created, well above

the 165,000 that was expected. In addition, private employers added 246,000

new jobs in February, also well above expectations. While this is good

news, it's important to note that job creations in January were revised

downward to 119,000 from the previous reading of 157,000.

There was more good news in the report: the Unemployment Rate fell to 7.7%

from 7.9%, a four-year low. However, the downtick in the unemployment rate

was due to more people leaving the labor force. And the Labor Force

Participation Rate (LFPR) continues to decrease, coming in at its lowest

level since September 1981. The LFPR calculation is quite simple. If you

are 16 years old and not in the military, then you either have a job or you

don't. The ratio of people "participating" or working is then

compared to the total population.

All in all, the Jobs Report showed that the labor market is slowly

improving. And there was more evidence that the housing market continues to

improve. Research firm CoreLogic reported that home prices rose 0.7% from

December to January and surged nearly 10% compared to a year ago. The 10%

increase was the largest yearly increase since April 2006 and was the

eleventh monthly increase in a row. Though not all the economic news was

rosy: Worker Productivity in the 4th quarter of 2012 slowed to its slowest

pace in four years. This coincides with the slow growth that was recently

reported in the Gross Domestic Product reading for the same period.

What does all of this mean for home loan rates? The good economic

news has caused investors to move money out of Bonds and into riskier

assets like Stocks, to try to take advantage of gains. As a result, Stocks

reached record highs last week, at the expense of Bonds. However, the Fed

continues purchasing $85 billion in Bonds every month as part of their Bond

purchase program known as Quantitative Easing. Plus, there is also

continued uncertainty out of Europe, meaning some investors will likely

continue their safe haven trade into our Bond Market. Overall, this should

help keep Mortgage Bonds--and therefore home loan rates, which are tied to

Mortgage Bonds--near record best levels.

The bottom line is that now remains a great time to consider a home

purchase or refinance, as home loan rates remain near historic lows. Let me

know if I can answer any questions at all for you or your clients.

|

|

|

|

Chart: Fannie Mae 3.0% Mortgage Bond (Friday Mar 08, 2013)

The

second half of the week heats up with several key reports. The

second half of the week heats up with several key reports.

- Economic reports kick off on Wednesday with Retail

Sales.

- As usual, Thursday brings Weekly Initial Jobless

Claims, as well as the wholesale-measuring Producer Price Index,

the first of the week's inflation reports.

- There's more inflation news on Friday with the Consumer

Price Index. Also look for Empire Manufacturing and Consumer

Sentiment to conclude the week.

Remember: Weak

economic news normally causes money to flow out of Stocks and into Bonds,

helping Bonds and home loan rates improve, while strong economic news

normally has the opposite result. The chart below shows Mortgage Backed

Securities (MBS), which are the type of Bond that home loan rates are based

on.

When you see these Bond prices moving higher, it means home loan

rates are improving -- and when they are moving lower, home loan rates are

getting worse.

To go one step further -- a red "candle" means that MBS worsened

during the day, while a green "candle" means MBS improved during

the day. Depending on how dramatic the changes were on any given day, this

can cause rate changes throughout the day, as well as on the rate sheets we

start with each morning.

As you can see in the chart below, Bonds worsened last week as Stocks hit

record highs. But Bonds and home loan rates remain near record best levels

and I will continue to watch their movement closely.

|

|

|

|

The Mortgage

Market Guide View...

|

|

|

|

New

Report Says Blogs More Influential than Facebook, Twitter

Have you been wondering how to get more attention from your

marketplace? Are you trying to find new ways to bring in more business?

Well, if you haven't already started blogging, you may want to give it

another look.

Technorati Media, one of the largest social media ad networks, recently

released their 2013 Digital Influence Report--a survey including over

6,000 influencers, 1,200 consumers and 150 other top marketers--revealing

when it comes to making purchase decisions, blogs are the third most

influential resource (31 percent!), second only to retail and brand sites.

The survey participants said blogs rank higher than Twitter for shaping

their opinions and higher than Facebook for motivating purchasing

decisions. The reason? Bloggers tend to be more honest with their opinions

and are perceived as less self-serving than other sources.

Here are four ways to be influential with your online community:

Be honest. People turn to blogs because they want honest opinions

and professional advice. Don't be afraid to be yourself or use some

personality both with your topics and your writing style.

Focus on providing value. Building strong relationships with your

followers is easy when you provide great value for them. Relationships are

really a by-product of providing great content and a sense of community.

Be the go-to. Becoming a local guru is neither difficult nor

undesirable. If you can establish yourself as a trusted source of

information, people will follow you for your specific advice...and so will

the business.

Get synergy. Don't ignore Facebook or Twitter, but don't rely on

them for the full job. When you provide compelling content on your blog,

use social media to amplify the content. The key to influencing your

customers on Facebook is to share things that generate likes, comments, and

interaction. Blog posts are a great way to do just that!

Economic

Calendar for the Week of March 11 - March 15

Date

|

ET

|

Economic Report

|

For

|

Estimate

|

Actual

|

Prior

|

Impact

|

Wed. March 13

|

08:30

|

Retail Sales

|

Feb

|

NA

|

|

0.1%

|

HIGH

|

Wed. March 13

|

08:30

|

Retail Sales

ex-auto

|

Feb

|

NA

|

|

0.2%

|

HIGH

|

Thu. March 14

|

08:30

|

Jobless Claims

(Initial)

|

3/09

|

NA

|

|

NA

|

Moderate

|

Thu. March 14

|

08:30

|

Producer Price

Index (PPI)

|

Feb

|

NA

|

|

0.2%

|

Moderate

|

Thu. March 14

|

08:30

|

Core Producer

Price Index (PPI)

|

Feb

|

NA

|

|

0.2%

|

Moderate

|

Fri. March 15

|

08:30

|

Consumer Price

Index (CPI)

|

Feb

|

NA

|

|

0.0%

|

HIGH

|

Fri. March 15

|

08:30

|

Core Consumer

Price Index (CPI)

|

Feb

|

NA

|

|

0.3%

|

HIGH

|

Fri. March 15

|

08:30

|

Empire State

Index

|

Mar

|

NA

|

|

10.0

|

Moderate

|

Fri. March 15

|

10:00

|

Consumer

Sentiment Index (UoM)

|

Mar

|

NA

|

|

77.6

|

Moderate

|

|

|

|

The material

contained in this newsletter is provided by a third party to real estate,

financial services and other professionals only for their use and the use

of their clients. The material provided is for informational and

educational purposes only and should not be construed as investment and/or

mortgage advice. Although the material is deemed to be accurate and

reliable, we do not make any representations as to its accuracy or

completeness and as a result, there is no guarantee it is without errors.

As your mortgage

professional, I am sending you the MMG WEEKLY because I am committed

to keeping you updated on the economic events that impact interest rates

and how they may affect you.

is the copyright

owner or licensee of the content and/or information in this email, unless

otherwise indicated. does not grant to you a license to any content,

features or materials in this email. You may not distribute,

download, or save a copy of any of the content or screens except as

otherwise provided in our Terms and Conditions of Membership, for any

purpose.

|

|

No comments:

Post a Comment