|

|

| |

| | Provided to you Exclusively by Jeff Porter |

|

| For the Month of September 2011 --- Vol. 6, Issue 9 | |

| | IN THIS ISSUE... |

| |

| | | |

| | "Watch Closely Now…Are You Watching Me Now?" - Kris Kristofferson. With the recovery slowing, the markets are looking closely for any indication of where the US economy is headed. This month's issue focuses on what you need to know about the national economy and your own personal financial picture:

| |

| |

| | All Eyes on the Fed Heading into September |

| |

| | | |

| | The slowing economic recovery has filled the news lately, which has market analysts and experts looking to the Fed for new policies that would help the economic recovery pick up again. And that means all eyes are on the face of the Fed: Fed Chair Ben Bernanke. But in Bernanke's recent speech at Jackson Hole, Wyoming, the markets were disappointed…not because of what Bernanke said, but because of what he was reluctant to say. Here's what you need to know.  A reason to remain optimistic. Bernanke focused on the near-term and long-term economic situation, but his message was optimistic, stating that regardless of "the crisis and the recession, the U.S. economy remains the largest in the world." He stated that the Fed expects "a moderate recovery" to continue and even strengthen as the country goes forward. A reason to remain optimistic. Bernanke focused on the near-term and long-term economic situation, but his message was optimistic, stating that regardless of "the crisis and the recession, the U.S. economy remains the largest in the world." He stated that the Fed expects "a moderate recovery" to continue and even strengthen as the country goes forward. Taking it easy on the talk of "Quantitative Easing." Despite the market's concerns over the slowing economic recovery, Bernanke didn't discuss any details about the measures that the Fed may use to help get the recovery back on track - which means there was no mention of a third round of Quantitative Easing (QE3). Instead, he stated that the Fed would continue to consider such options at its upcoming September meeting. He did, however, re-iterate that "The Fed has a range of tools that could be used to provide additional monetary stimulus." Additionally, he ended his speech by saying: "The Federal Reserve will certainly do all that it can to help restore high rates of growth and employment in a context of price stability." Right back where we started. It's interesting to note that last year when Bernanke spoke at Jackson Hole he talked about the likelihood of a second round of Quantitative Easing (or QE2). That speech sent both the Bond and Stock markets into a rally mode. Amazingly, the Stock market is very close to levels seen last August, which means that Stocks have given up virtually all of the gains seen from the enormous rally sparked by QE2. With the Fed pushing off any meaningful discussion of its policies and options until the September meeting, this story is sure to continue impacting the markets. Until we hear exactly what the Fed will do, the markets will be forced to speculate and anticipate - which could mean more volatility. For now, the situation looks beneficial for people looking to purchase a home or refinance, as home loan rates remain near historic lows. But things can change quickly, so now is the time to take a look at the options available. | |

| |

| | Tick Tock: It’s Time for a Home Loan Check Up |

| |

| | | |

| |  They say that home is where the heart is. Yet do you know that a mortgage is the heart of every good financial plan? They say that home is where the heart is. Yet do you know that a mortgage is the heart of every good financial plan? Making sure you have the right one can save you a ton, along with creating wealth and financial health for your family. And with home loan rates near historic lows, now is the perfect time for a home loan check up. When it comes to determining if your mortgage is still the right one for you, some important factors to consider include the type of loan (or loans) you currently have, your current loan balance, your current interest rate, and any recent or upcoming changes to your financial situation (i.e. job change, marriage, divorce, kids going to college, etc). One of the most important documents is called the Note, which you will clearly see labeled on the top of the form. It is several pages long, and you probably have several copies of it. This document will tell you the amount of your original loan, as well as the interest rate you closed at, and most importantly, the terms of the loan itself. Oftentimes, there is an addendum to the Note, which may or may not be directly attached to it, which can explain more details about an Adjustable Rate Mortgage (ARM). If you have an ARM, your Note will say how often your interest rate will adjust (for example, annually, semi-annually, or monthly). In addition, the Note will explain if your ARM carries a Prepayment Penalty. These are key factors in determining whether your current ARM remains the best loan for your situation. Just as it is important to gather the information on your first mortgage, you should also gather the information for your second mortgage, if you have one. While analyzing your home loan can seem like a daunting task, have no fear. I'll be happy to help you look at your options to make sure your mortgage still fits your short- and long-term financial goals. After all, no one wants to look back and realize that a great opportunity to improve their financial situation has passed them by. | |

| |

| | Q&A: Home Prices? |

| |

| | | |

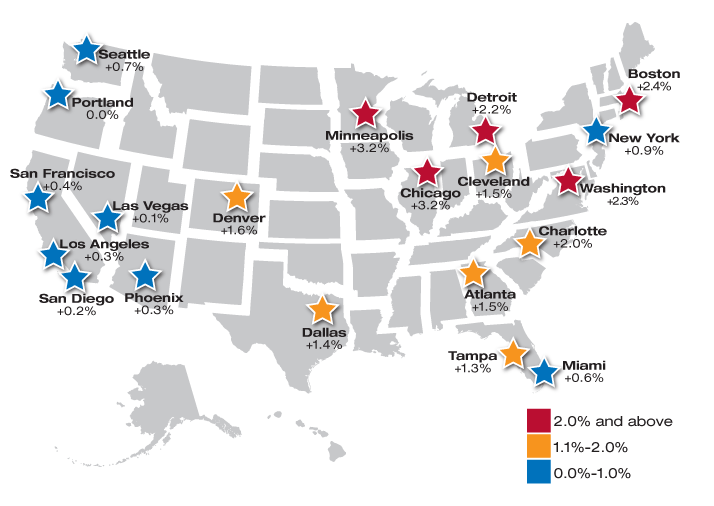

| | QUESTION: Where are home prices headed? ANSWER: Home prices are being watched closely these days. Homeowners keep an eye on the price of their own investment while potential new homeowners look for the best prices to purchase a home. And market experts monitor the housing market to see if the economic recovery is taking hold. Just the other day, the latest numbers for the Case-Shiller Index were released showing that the average home price climbed for the third straight month. Some of the gains may be seasonal, but the news is good for now - especially since 19 of the 20 cities in the Index showed increases. The map below shows you which cities showed the biggest gains and allows you to see where home prices are headed in different regions. If you have any questions about the trend in home prices and what it means to the housing and mortgage industries, simply call or email today. I'll be happy to sit down with you and discuss the factors that impact home affordability and your unique situation. >  | |

| |

| |

| | | |

| | Mortgage Success Source, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Success Source, LLC does not grant to the recipient or distributor a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content except as otherwise provided in our Terms and Conditions of Membership, for any purpose.  | |

![[% COMPANY %]](http://www.mmgweekly.com/mmgm_member_images/pri/10051/images/sun-valley-mortgage-logo.gif-final.gif)

No comments:

Post a Comment