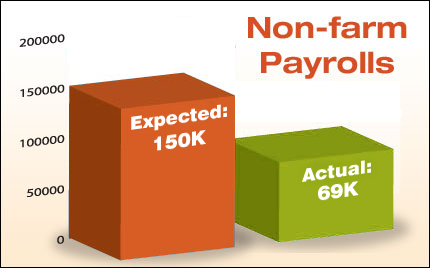

| There’s good, there’s bad, and there’s ugly. And the Jobs Report for May was just plain ugly, with not one good data point within the release. Read on for details...and what they mean for home loan rates.  On Friday, the On Friday, the Labor Department reported that 69,000 jobs were created in May, with 82,000 private sector job gains offsetting government jobs losses. This was a HUGE downside miss - basically half of what was expected. Adding to the pain were downward revisions to the previous two months, which erased another 49,000 jobs from what was previously reported. And if that wasn't enough, the unemployment rate ticked up to 8.2%, when expectations were for it to hold steady.

The Labor Force Participation Rate (LFPR) actually improved by .2% to 63.8, but it is still hovering at a 31-year low. The LFPR is quite simple: If you are 16 years of age and not in the military and you have a job, then you are participating. If you don't have a job, you are not participating - that is how the ratio is measured. The big picture is how do we as a country reverse this significantly negative trend? We must have more people participating or working to help pay for those who are not.

So what does all of this mean for home loan rates? Remember that weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve. And last week, several weak economic reports and the ongoing drama in Europe helped home loan rates reach record best levels. With inflation moderating, Stocks getting killed, and the US Dollar very strong thanks to the drama in Europe, the Fed has room for more stimulus (known as Quantitative Easing, or QE3). But it’s important to note that with home loan rates already at historic lows, another round of easing probably won’t cause home loan rates to move much lower.

The bottom line is that home loan rates remain near historic lows and now continues to be a great time to purchase or refinance a home. Let me know if I can answer any questions at all for you or your clients. |

No comments:

Post a Comment