| “Both optimists and pessimist contribute to our society. The optimist invents the airplane, and the pessimist—the parachute.” G.B. Stern. And last week, we saw sentiment on the economy go from pessimistic, to optimistic, and back to pessimistic—all within a week! Here are the highlights of what happened.

On the optimistic side, several economic reports were better than expected. On the optimistic side, several economic reports were better than expected.

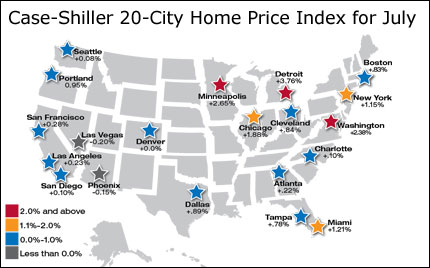

For example, New Home Sales for August were up 6.1% from a year earlier and the Case-Shiller Home Price Index rose in July from June in the 10 and 20 city survey, and was the fourth monthly gain in a row.

What’s more, there was some positive news from overseas. European leaders are designing a Special Purpose Vehicle (SPV) that would issue Bonds and purchase European debt to try to contain the malaise in that region. Plus, Germany voted in support for the expansion of the European Financial Stability Facility (EFSF), which will be used to help Euro member countries access capital. This is optimistic news, as it shows Germany is doing whatever it can to help debt laden countries avoid default and potentially threaten the Euro union.

While this mix of news was great for our economy and the global economy, the result was a "risk on trade" where investors fled the safe haven trade of Bonds and moved into Stocks to try and take advantage of gains. And since home loan rates are tied to Mortgage Bonds, when Bonds worsen home loan rates worsen as well. That’s what we saw happen in the early and middle part of last week.

But some pessimism crept back into the markets late last week as China's Manufacturing PMI contracted for a third consecutive month. There is growing fear that a slowdown in China could affect the already fragile global economy. This is a developing story and one I will be watching closely because if China’s economy does meaningfully slow, it will likely take Stocks down another level and help Bonds and home loan rates. Also creating some pessimism late in the week: Personal Income was lower than expected, and seeing earnings contract is not a good sign for the economy.

The bottom line is that now is a great time to purchase or refinance a home, as home loan rates remain near historic lows. Let me know if I can answer any questions at all for you or your clients. |

No comments:

Post a Comment