|

"Bad news goes about in clogs, good

news in stockinged feet." Welsh

Proverb. And

we certainly saw both good and bad news in the economic

reports released

last week. Here are the details...and what they mean for home

loan rates.

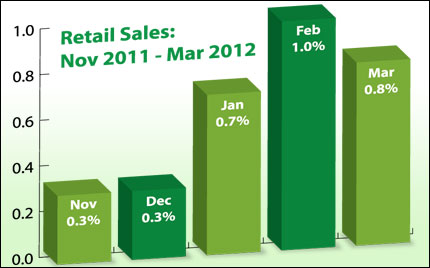

On

the good side, Retail Sales in March On

the good side, Retail Sales in March

rose by a nice 0.8%, as consumers

bought all kinds of products across the

board. And when stripping out

autos,

sales still grew. This adds to the increasing

trend seen in January

and February and

is a good sign for our economy, as

consumers don't spend

when they aren't

feeling optimistic about their financial situation.

But over in the manufacturing sector it

was

not as pretty a picture, as both the Empire

State Manufacturing Index

and the Philly

Fed Index came in below expectations. This is largely being

attributed to a global

slowdown, and experts say that the outlook for our

manufacturing remains positive…

but just not accelerating at the present

time. Things weren't as pretty in the

housing sector either, as both

Existing Home Sales and Housing Starts fell in March.

And things in the labor market were

verging on ugly, as Initial Jobless Claims

spiked sharply higher. The Labor

Department reported 386,000 fresh Claims

in the latest week, above the

375,000 that was expected...and well above the

350,000 range seen in recent

weeks.

Also verging on ugly was news out of Europe.

There is growing and very justified

concern about Spain's ability to pay

down debt, meet new budget deficit

targets, and avoid a bailout or debt

restructuring. The Spanish situation

has prompted the G-20 (Finance

Ministers and Central Bankers of the 20

largest economies) to urge the

European Central Bank to do more to contain

their debt crisis as it

threatens global growth. And let's not forget that besides

Spain, we still

have France, Portugal, Ireland and Greece to deal with in future

months and

years.

So what does all of this mean

for Bonds and home loan rates? There will l

ikely be more

safe haven trading into the relative safety of the US Dollar and

US Bonds

(which will benefit Mortgage Bonds, to which home loan rates are

tied) as

the uncertainty out of Europe escalates. And more bad economic

reports here

in the United States could add to this safe haven trading into

our Bonds,

just as more good economic news here would likely benefit Stocks

at the

expense of our Bonds and home loan rates.

This mix of factors will

continue to impact the direction in which Bonds

and home loan rates move in

the weeks ahead. The takeaway is that

home loan rates remain near historic

lows and now continues to be a

great time to purchase or refinance a home.

Let me know if I can answer

any questions at all for you or your clients.

|

No comments:

Post a Comment