|

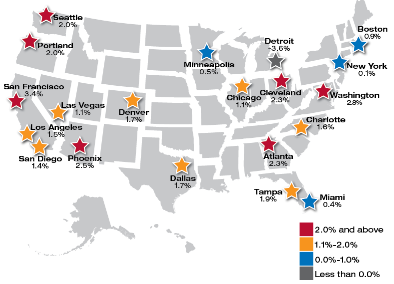

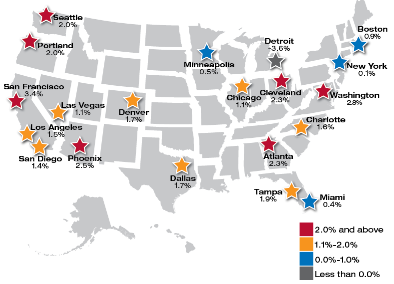

|  Although the economy as a whole has seen some signs of slowing, the housing market saw signs of a slight rise last month. According to the most recent release of the Case-Shiller Home Price Index, home prices increased in April from March. In fact, as you can see in the chart, 19 of the 20 cities in the index showed gains...and on average, prices increased 1.3%. Although the economy as a whole has seen some signs of slowing, the housing market saw signs of a slight rise last month. According to the most recent release of the Case-Shiller Home Price Index, home prices increased in April from March. In fact, as you can see in the chart, 19 of the 20 cities in the index showed gains...and on average, prices increased 1.3%.

Before we get too excited, however, we should bear in mind that year-over-year prices remain down 1.9%. But the trend is moving in the right direction. After all, the April number was up from the March year-over-year prices, which were down 2.9%. That suggests that the price declines are also slowing.

In other good housing news, last month's report on Pending Home Sales indicated a rise of 5.9% in May. To put it in perspective, that number was well above the 0.5% that was expected...not to mention leaps and bounds above the previous month's reading of -5.5%.

Still, change doesn't happen overnight, and the housing market is still going through pain, as evidenced last month by the Fed saying: "Despite some signs of improvement, the housing sector remains depressed."

Speaking of the Fed, here are some comments that Chicago Fed President Charles Evans made late last month:

"I think if you look at our projections and the SEPs, it's hard to understand why we (The Fed) wouldn't be willing to do more because the inflation outlook is lower than our objective..."

"At some point, we are likely to need to do more..."

"We should be doing more accommodation than what was adopted under the Twist..."

"Right off the bat, I'd be willing to do more on the basis of the current data..."

"I'd be willing to support more asset purchases, MBS, in order to provide more accommodation..."

How many times can a person refer to more stimulus in one interview?

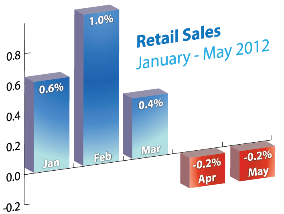

As those quotes indicate, the probability of a third round of Quantitative Easing (or QE3) continues to rise...especially when you consider the recent economic weakness in the US and uncertainty out of Europe. But if QE3 is officially announced--which could very well happen at the next Fed Meeting announcement on August 1st--it may pressure Bonds lower much like past official announcements. That's because more money printing "devalues" the US Dollar and denominated securities like US Bonds.

Now continues to be a great time to purchase or refinance a home, and home loan rates remain near historic lows. Let me know if I can answer any questions at all for you or someone you know.

|

|

No comments:

Post a Comment