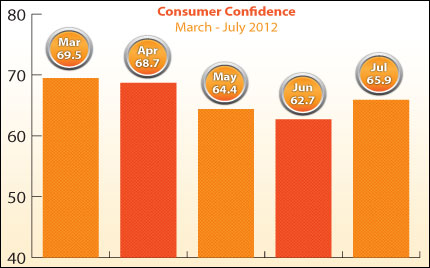

Survey says.... And last week, several important economic reports were released. Read on to find out what they said — and what they mean for home loan rates.  Last Friday, the Labor Last Friday, the Labor Department reported that 163,000 total jobs were created in July with 172,000 private gains offsetting modest government losses. And that wasn’t the only good news we saw last week. Consumer Confidence jumped to 65.9 in July, which was the best reading since April and above expectations. The July increase stopped a 4-month streak of declining readings. In addition, the Personal Consumption and Expenditures Index (PCE), the Fed’s favorite read on inflation, also came in tame.

There was some negative news within the Jobs Report. The Unemployment Rate ticked up to 8.3% and downward revisions to the prior two months erased 6,000 jobs from what was previously reported. Also, the Labor Force Participation Rate decreased, and there was no pickup in hours worked.

So what do these reports mean for our economy...and for home loan rates? Perhaps the bigger question to ask is: Is any of this news good enough to keep the Fed from doing another round of Bond buying (known as Quantitative Easing or QE3)? After last week’s meeting of the Federal Open Market Committee (FOMC), the Fed said that economic activity decelerated somewhat over the first half of this year, but they also stopped short of announcing plans for additional stimulus at this time.

Remember that if the Fed opts for more stimulus, the goal of QE3 will be to promote a stronger economic recovery. And once an official announcement is made, Bonds (and therefore home loan rates, which are tied to Mortgage Bonds) could suffer as Stocks would likely rally. However, there are many uncertainties on the horizon which should also support Bonds and home loan rates, including the ongoing drama in Europe.

The bottom line is that home loan rates remain near historic lows and now is a great time to consider a home purchase or refinance. Let me know if I can answer any questions at all for you or your clients. |

No comments:

Post a Comment