|

|

|

Last

Week in Review: Many communities are still reeling from Superstorm Sandy,

while the week also began and ended with important economic news.

Forecast

for the Week: Between the elections and the ongoing cleanup from Superstorm

Sandy, news outside the markets may take center stage this week.

View:

Check out four innovative ways to improve your productivity, and then share

these ideas with your clients, colleagues, and friends.

|

|

|

|

|

"What do we live for, if it is not

to make life less difficult for each other?" George Eliot. The

events surrounding Superstorm Sandy certainly put this sentiment into

perspective, as many communities continue to recover from last week’s

storm.

There

was also some important economic news to note last week. The biggest news

came on Friday, with the Jobs Report for October showing 171,000 new jobs

created, with a healthy 184,000 private job creations being offset by

modest government job losses. Adding to the good news were some upward

revisions to the prior two months’ reports, adding a net 84,000 jobs to

what had been previously reported. There

was also some important economic news to note last week. The biggest news

came on Friday, with the Jobs Report for October showing 171,000 new jobs

created, with a healthy 184,000 private job creations being offset by

modest government job losses. Adding to the good news were some upward

revisions to the prior two months’ reports, adding a net 84,000 jobs to

what had been previously reported.

The Unemployment Rate held steady at 7.9%

as expected, and the more important Labor Force Participation Rate (LFPR)

improved by a tick. The LFPR calculation is quite simple. If you are 16

years old and not in the military, then you either have a job or you don't.

The ratio of people "participating" or working is then compared

to the total population. All in all this was a pretty good report and, on

the heel of the modest improvement in Initial Jobless Claims, shows that

the labor market is still improving…slowly, but improving.

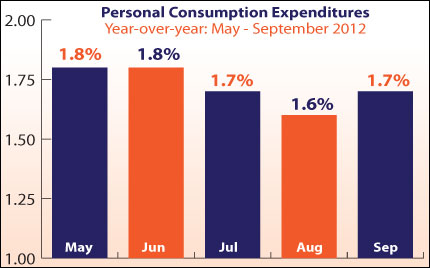

And the other big economic story from

last week: inflation as measured by the Core Personal Consumption

Expenditure (the Fed’s favorite measure of inflation) remained tame last

month. This is significant because inflation is the arch enemy of Bonds and

home loan rates (which are tied to Mortgage Bonds), since it reduces the

value of fixed investments like Bonds. Remember, though, that one of the

goals of the Fed’s latest round of Bond buying (known as Quantitative

Easing or QE3) is actually to increase inflation. This is an important

story to monitor in the weeks and months ahead.

The bottom line is that home

loan rates remain near historic lows, making now a great time to consider a

home purchase or refinance. Let me know if I can answer any questions at

all for you or your clients.

|

|

|

|

|

Chart: Fannie Mae 3.0% Mortgage Bond (Friday Nov 02, 2012)

A

slow week of economic reports comes at a time when news stories beyond the

markets will be taking center stage: A

slow week of economic reports comes at a time when news stories beyond the

markets will be taking center stage:

- The week starts off Monday morning with the ISM

Services report, which measures the non-manufacturing sector.

Leading up to this week’s report, the ISM Services Index has seen

three consecutive monthly increases and came in at its highest level

since March in the last report.

- On Thursday, we’ll see the weekly Initial

Jobless Claims report.

- Friday ends the week with a preliminary read on Consumer

Sentiment for November.

In addition to those reports, two news

stories will take center stage. First, the nation will continue to focus on

helping the East Coast clean up and recover from the devastation of

Hurricane Sandy.

Second, the presidential election will

undoubtedly overshadow much of the news early in the week. One issue that

will be important to watch after the election is how long it takes elected

officials to shift back to the impending fiscal cliff that the country is

headed towards. Remember, the United States’ mounting debt was a huge topic

over the last year or so. But, as the election neared, much of the debt

talk was silenced, as politicians from both major parties decided to wait

and see what the leadership will look like after the election. After all,

any approach to the problem will be impacted by who controls Congress and

which party is in the White House.

Remember: Weak economic news normally

causes money to flow out of Stocks and into Bonds, helping Bonds and home

loan rates improve, while strong economic news normally has the opposite

result. The chart below shows Mortgage Backed Securities (MBS), which are

the type of Bond that home loan rates are based on.

When you see these Bond

prices moving higher, it means home loan rates are improving — and when

they are moving lower, home loan rates are getting worse.

To go one step further — a red “candle”

means that MBS worsened during the day, while a green “candle” means MBS

improved during the day. Depending on how dramatic the changes were on any

given day, this can cause rate changes throughout the day, as well as on

the rate sheets we start with each morning.

As you can see in the chart below, Bonds

and home loan rates rebounded after their initial reaction to the

optimistic Jobs Report and they remain near their historic lows. I’ll be

watching closely to see what happens this week.

|

|

|

|

The Mortgage

Market Guide View...

|

|

|

|

|

|

Pushups for Your Brain

Improving brain function is not just a

fad for MENSA aspirants anymore, it's big news and the scientific community

involved means business. Here are four innovative ways to test your own

brain function, and help improve your cognitive ability and workplace

productivity. Be sure to check them out and share them with clients,

colleagues, and friends.

Psychometrics measures cognitive

performance in areas like reaction time, executive function, and verbal

learning. First, you take a battery of tests to see your current cognitive

performance; then you introduce and track a new behavior, called

"interventions" to understand whether it helps or hurts your

thinking. The intervention can include changes to work routine, diet, even

what time you drink coffee or smoke a cigarette. www.quantified-mind.com/about

Brain Training involves playing simple

games that build your memory, problem solving abilities, and other

cognitive functions that are critical to professional work environments. www.lumosity.com

Neurofeedback tools require users to wear

an EEG headband with small sensors that track brain waves. The devices are

wireless and create real-time analytics with your PC or smartphone,

measuring how deeply you focus on any given job task, helping you monitor

and minimize distraction and stay in a productive state longer. www.axioinc.com/the-product.html

Nudgers are mobile apps or online tools

that ping you with reminder questions such as, "When was the last time

you drank a glass of water?" or "Did you take a walk today?"

Behavioral researchers have long realized people often don't do what they

say they want to do. Nudgers can be one way to make sure you keep your New

Year's resolution, or any other new habit you'd like to build. www.beeminder.com

Remember, as a general rule,

weaker than expected economic data is good for rates, while positive data

causes rates to rise.

Economic

Calendar for the Week of November 05 - November 09

|

Date

|

ET

|

Economic Report

|

For

|

Estimate

|

Actual

|

Prior

|

Impact

|

|

Mon. November 05

|

10:00

|

ISM Services

Index

|

Oct

|

NA

|

|

55.1

|

Moderate

|

|

Wed. November 07

|

03:00

|

Crude

Inventories

|

Sep

|

NA

|

|

-2.045M

|

Low

|

|

Thu. November 08

|

08:30

|

Jobless Claims

(Initial)

|

11/03

|

NA

|

|

363K

|

Low

|

|

Fri. November 09

|

09:00

|

Consumer

Sentiment Index (UoM)

|

Nov

|

NA

|

|

82.6

|

Low

|

|

|

|

|

The material

contained in this newsletter is provided by a third party to real estate,

financial services and other professionals only for their use and the use

of their clients. The material provided is for informational and

educational purposes only and should not be construed as investment and/or

mortgage advice. Although the material is deemed to be accurate and

reliable, we do not make any representations as to its accuracy or

completeness and as a result, there is no guarantee it is without errors.

As your mortgage

professional, I am sending you the MMG WEEKLY because I am committed

to keeping you updated on the economic events that impact interest rates

and how they may affect you.

is the copyright

owner or licensee of the content and/or information in this email, unless

otherwise indicated. does not grant to you a license to any content, features

or materials in this email. You may not distribute, download,

or save a copy of any of the content or screens except as otherwise

provided in our Terms and Conditions of Membership, for any purpose.

|

|

No comments:

Post a Comment