|

|

|

Last

Week in Review: There was some negative economic news

and more pessimism out of Europe. How did home loan rates react?

Forecast

for the Week: Big jobs news is coming at the end of

the week. Plus, the minutes from the Fed’s latest meeting will be released.

View:

Hispanic Heritage Month ends on October 15, making this the perfect time to

connect with your Spanish-speaking clients.

|

|

|

|

|

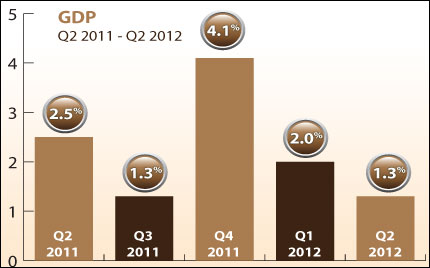

A “Gross” Domestic Product. And

last week’s final reading of GDP for the second quarter was far from

pretty. Read on to learn why this matters…and how home loan rates are

faring.

Last

week, the final reading of GDP for the second quarter was reported at an

anemic 1.3%. This was after a sizable downward revision to previous

estimates—and this is significant because GDP is the broadest measure of

economic activity. In addition, Durable Goods Orders (i.e. orders for

products like furniture and computers that are designed to last for an

extended period of time) came in shockingly low. Figures like these speak

to the improvement needed in our economy, and are a big reason why the Fed

announced its latest round of Bond buying (known as Quantitative Easing or

QE3) on September 13. Last

week, the final reading of GDP for the second quarter was reported at an

anemic 1.3%. This was after a sizable downward revision to previous

estimates—and this is significant because GDP is the broadest measure of

economic activity. In addition, Durable Goods Orders (i.e. orders for

products like furniture and computers that are designed to last for an

extended period of time) came in shockingly low. Figures like these speak

to the improvement needed in our economy, and are a big reason why the Fed

announced its latest round of Bond buying (known as Quantitative Easing or

QE3) on September 13.

There was some surprisingly good news

last week, as Initial Jobless Claims came in at 359,000, much better than

expected and the best reading since late July. One of the main objectives

of QE3 is to promote job growth, which is essential for our economy to

grow. Time will tell if QE3 and this money injection into the economy will

spark economic growth and lower unemployment…or if it will devalue the U.S.

Dollar, raise commodity and asset prices like Stocks, and heighten

inflation fears.

So what does all of this mean

for home loan rates? Inflation is the arch enemy

of Bonds and home loan rates because it reduces the value of fixed

investments like Bonds. If inflation does creep into the economy, this

could have a negative impact on Bonds and home loan rates in the coming

months.

On the flip side of that, negative

economic news like the GDP Report and Durable Goods Orders often causes

investors to move their money out of risky investments like Stocks and into

safer investments like Bonds, including Mortgage Bonds (which home loan

rates are based on). That’s why home loan rates often improve when our

economy is struggling. In addition, investors also tend to move their money

into safe investments like our Bonds during times of global uncertainty,

such as last week’s strikes in Greece and riots in Spain. These two factors

and the Fed’s QE3 Mortgage Bond purchases are the main reasons that Bonds

and home loan rates have improved of late.

The bottom line is that home

loan rates remain near historic lows, meaning now is a great time to

consider a home purchase or refinance. Let

me know if I can answer any questions at all for you or your clients.

|

|

|

|

|

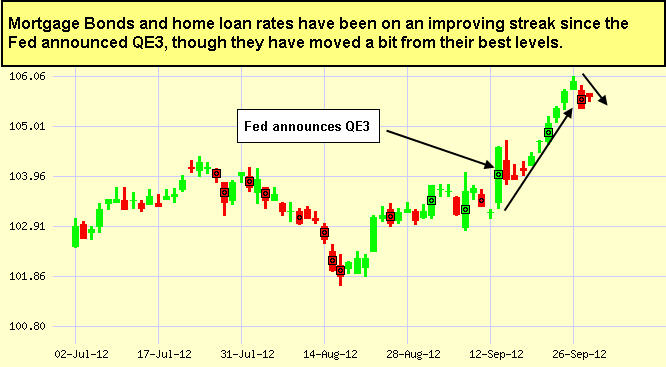

Chart: Fannie Mae 3.0% Mortgage Bond (Friday Sep 28, 2012)

Big

economic data will be released at the end of this week…but there are a

number of reports that will build the anticipation as the week goes on! Big

economic data will be released at the end of this week…but there are a

number of reports that will build the anticipation as the week goes on!

- Economic data starts right off on Monday with the ISM Manufacturing Index,

which will be followed

by the ISM

Service Sector Index on Wednesday.

- The ADP Employment Report for September will also be delivered on Wednesday.

- The Labor Department will report the Weekly Initial Jobless Claims

data on Thursday. This week’s report comes after last

week's number was the lowest since late July, so the markets will be

watching to see if the good news continues.

- Finally on Friday, the government's Jobs Report

for September will be released with Non-Farm Payrolls and the Unemployment Rate.

Beyond the jobs data, the minutes from

the Fed’s latest Federal Open Market Committee Meeting should also garner

attention on Wednesday.

Remember: Weak economic news normally

causes money to flow out of Stocks and into Bonds, helping Bonds and home

loan rates improve, while strong economic news normally has the opposite

result. The chart below shows Mortgage Backed Securities (MBS), which are

the type of Bond that home loan rates are based on.

When you see these Bond

prices moving higher, it means home loan rates are improving — and when

they are moving lower, home loan rates are getting worse.

To go one step further — a red “candle”

means that MBS worsened during the day, while a green “candle” means MBS

improved during the day. Depending on how dramatic the changes were on any

given day, this can cause rate changes throughout the day, as well as on

the rate sheets we start with each morning.

As you can see in the chart below, Bonds

and home loan rates have been on an improving streak since the Fed

announced QE3. I’ll be watching closely to see what happens this week.

|

|

|

|

The Mortgage

Market Guide View...

|

|

|

|

|

|

Hispanic Heritage Month:

Sept. 15 – Oct. 15, 2012

The Hispanic population is the largest

ethnic or minority race in America. In fact, 52 million Hispanics now live

in the United States…which is more than double from 20 million in 1990. By

the year 2050, the Hispanic population in the U.S. is estimated to reach

132 million!

Reach out…

Now’s the perfect time to connect with

your Spanish-speaking clients and potential clients by wishing them a happy

Hispanic Heritage Month this September 15 through October 15!

A little history…

Originally authorized by President Lyndon

Johnson in 1968 as National Hispanic Heritage Week, the observance was

expanded to a month-long celebration in 1988. September 15 was chosen as

the first day of the celebration because it is celebrated as the

independence day of five Latin American countries: Costa Rica, El Salvador,

Guatemala, Honduras, and Nicaragua. In addition, Mexico celebrates its

independence on September 16, and Chile celebrates on September 18.

Discover more…

Read stats and facts about Hispanic

Heritage Month on the U.S. Census Bureau’s facts and features page! You can even pass the link on

to clients and referral partners who might be interested in learning more.

Economic

Calendar for the Week of October 01 - October 05

|

Date

|

ET

|

Economic Report

|

For

|

Estimate

|

Actual

|

Prior

|

Impact

|

|

Mon. October 01

|

10:00

|

ISM Index

|

Sept

|

NA

|

|

49.6

|

HIGH

|

|

Wed. October 03

|

10:00

|

ADP National

Employment Report

|

Sept

|

NA

|

|

201K

|

HIGH

|

|

Wed. October 03

|

10:00

|

ISM Services

Index

|

Sept

|

NA

|

|

53.7

|

Moderate

|

|

Wed. October 03

|

02:00

|

FOMC Minutes

|

Sept

|

NA

|

|

NA

|

HIGH

|

|

Thu. October 04

|

08:30

|

Jobless Claims

(Initial)

|

9/29

|

NA

|

|

NA

|

Moderate

|

|

Fri. October 05

|

08:30

|

Non-farm

Payrolls

|

Sept

|

NA

|

|

96K

|

HIGH

|

|

Fri. October 05

|

08:30

|

Unemployment

Rate

|

Sept

|

NA

|

|

8.1%

|

HIGH

|

|

Fri. October 05

|

08:30

|

Hourly Earnings

|

Sept

|

NA

|

|

0.0%

|

HIGH

|

|

Fri. October 05

|

08:30

|

Average Work

Week

|

Sept

|

NA

|

|

34.3

|

HIGH

|

|

|

|

|

The material

contained in this newsletter is provided by a third party to real estate,

financial services and other professionals only for their use and the use

of their clients. The material provided is for informational and

educational purposes only and should not be construed as investment and/or

mortgage advice. Although the material is deemed to be accurate and

reliable, we do not make any representations as to its accuracy or

completeness and as a result, there is no guarantee it is without errors.

As your mortgage

professional, I am sending you the MMG WEEKLY because I am committed

to keeping you updated on the economic events that impact interest rates

and how they may affect you.

is the copyright

owner or licensee of the content and/or information in this email, unless

otherwise indicated. does not grant to you a license to any content,

features or materials in this email. You may not distribute,

download, or save a copy of any of the content or screens except as

otherwise provided in our Terms and Conditions of Membership, for any purpose.

|

|

No comments:

Post a Comment